Market Summary August-September 2013

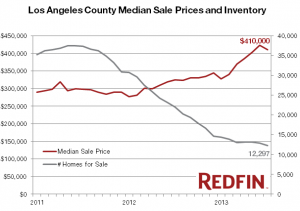

While Los Angeles County remains one of the nation’s hottest real estate markets, the home-buying frenzy that consumed the city over the past six months has started to ease. Since late 2012, rising home prices and historically low mortgage rates drew buyers from all walks of life—first-time buyers, foreign buyers, institutional investors, and home flippers alike. Increased demand and low inventory triggered aggressive bidding wars, causing median sale prices to rise 26 percent between July 2012 and July 2013.

Redfin agents reported that competition turned a corner starting in late June as buyers started to burn out. Agents in July noted that five to ten offers on a property were the norm when in the years prior agents and sellers were thrilled to get just a single offer.

LA’s steep home-price growth and climbing interest rates have also priced many buyers out of the market. Median home prices in Los Angeles County and average interest rates have grown from approximately $325,000 and 3.5 percent to $410,000 and 4.5 percent between July 2012 and July 2013. This means that buyers now need to cough up at least $600 more per month on a mortgage in order to afford a comparable home.